Pouppy 2.0: Designing for Permanence

A Design Engineer Case Study on Product Stance, System Design, and Financial Awareness

What it is

A personal finance product focused on sustaining financial awareness over time, not on automation or performance optimization.

What I did

End-to-end product work: framing the problem, defining the product stance, designing the experience, and building the system as a Design Engineer.

Skills

Product thinking, design engineering, system design, applied JTBD, and use of AI as build infrastructure.

Why it matters

It shows the ability to design and build products that challenge default assumptions and prioritize long-term human experience over short-term efficiency.

The Starting Point

The relationship most people maintain with money tends to oscillate between two unstable states: obsessive control and total avoidance. Spreadsheets, dashboards, and automated apps promise clarity, but often increase cognitive fatigue. When the effort to look becomes emotionally costly, people stop looking.

The issue is not a lack of information. It is the inability to sustain attention without triggering guilt, anxiety, or self-judgment. Financial tools often operate as retrospective mirrors: they show damage after it has already occurred, reinforcing avoidance instead of awareness.

The real break with existing solutions happens when users realize that knowing more does not necessarily help them stay present. Every month feels like a reset without memory, eroding confidence in one’s own judgment.

You can try it for free :)

Finance as time consciousnessOr look at our demo!

Milo's profileThe Product Stance

Pouppy is built around a single, deliberate stance: prioritizing permanence over optimization.

Instead of maximizing automation, Pouppy reduces the emotional cost of looking. Instead of treating finance as a performance test, it treats it as a relationship that must endure over time.

This stance implies clear choices:

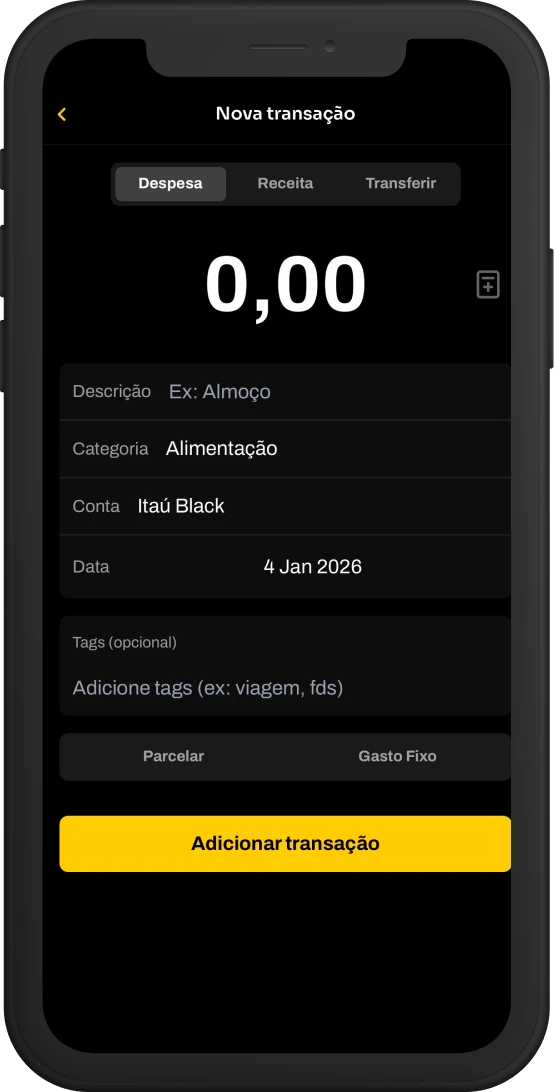

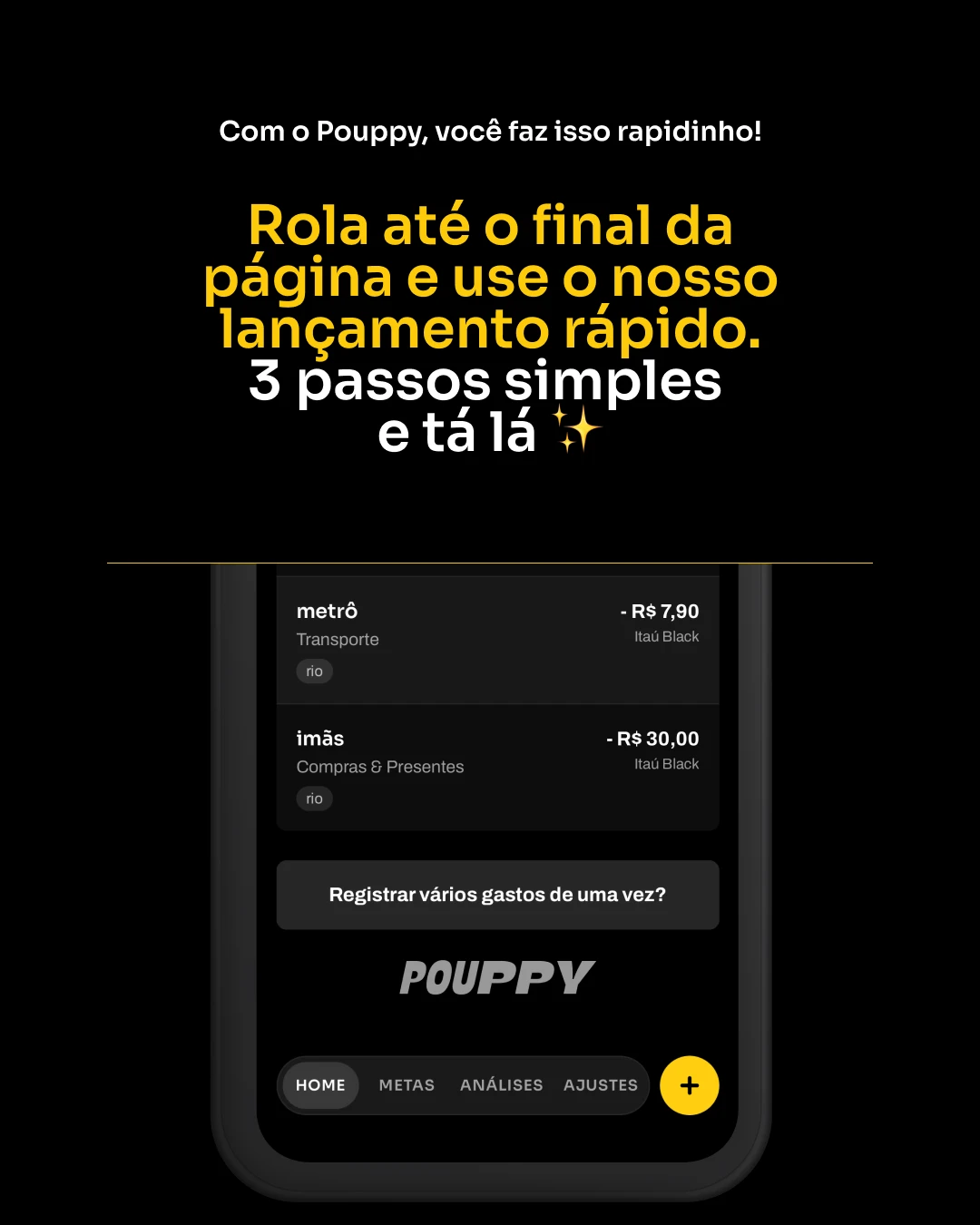

- Manual logging is preserved as a conscious gesture, not a technical limitation.

- The product avoids behaving like accounting software or performance dashboards.

- The primary success criterion is not numerical precision, but the user’s willingness to return.

The goal is not simply to retain money, but to sustain contact with financial reality without triggering flight responses.

The Continuous Gesture (JTBD)

Pouppy supports a single, continuous job with multiple derived expressions:

to sustain awareness of one’s own financial behavior over time, without collapsing into denial, panic, or improvisation.

"The app does everything on its own, so I stop opening it. When I finally check, the bill is at 5k and I never felt the weight.

— Social listening, Reddit

This job cannot be split into functional, emotional, or social layers without losing coherence. Understanding spending, managing anxiety, and maintaining a sense of adult responsibility operate together, not in parallel.

To validate this gesture, we used the Jobs to Be Done lens as a decision filter rather than a segmentation tool, mapping forces that either pull users toward awareness or push them back into avoidance.

Forces of Progress

- Push: Disorientation caused by invisible spending, delayed bills, and automation fatigue.

- Pull: Relief generated by clear perception, non-judgmental feedback, and a trusted ritual.

- Anxiety: Fear of failure, complexity, and being evaluated by the tool itself.

- Habit: The inertia of ignoring small expenses or returning to chaotic personal systems.

Design decisions throughout the product were tested against a single question: does this help the user keep looking, or does it give them another reason to flee?

Market Value Shift

Most financial tools compete along the same axes: automation depth, analytical density, and control intensity. Pouppy deliberately exits this space.

Instead of asking how much can be automated, Pouppy asks how long attention can be sustained.

This shift produces a different value curve:

- Automation is reduced rather than expanded.

- Category complexity is constrained.

- Punitive alerts and performance framing are removed.

What is created in their place is not efficiency, but permanence: a product that remains usable even when the user is inconsistent, tired, or emotionally overloaded.

In this sense, Pouppy does not promise immediate mathematical gains. It promises continuity of contact, which becomes the condition for any long-term financial decision.

Technology as Infrastructure

Technology in Pouppy is not positioned as a source of answers. It is used to qualify questions.

Throughout the build process, AI and agentic tools were employed not to accelerate toward easy solutions, but to deliberately tension them. Instead of asking systems to decide or optimize, they were used to surface alternatives, challenge assumptions, and help clarify what the real problem was at each stage of the product.

This was also a pragmatic choice. Pouppy is built by someone who is not a traditional software engineer. AI-assisted tooling functioned as infrastructural support: enabling architectural exploration, prototyping, and visual reasoning that would otherwise be inaccessible. In this sense, AI expands authorship rather than replacing expertise.

Equally important, AI was used as a co-creative partner to explore form. Many of the visual and interaction experiments in Pouppy emerged from tensioning models against specific constraints and sensibilities. The process was iterative and imperfect by design: models rarely returned the desired outcome on the first attempt, requiring continuous reframing, correction, and interpretation.

At the experience level, however, Pouppy deliberately avoids AI-driven features. No predictions, recommendations, or automated categorizations are exposed to the user. This separation protects the core stance of the product: the act of registering and reflecting must remain intentional, legible, and owned by the person.

In practice, this means:

- AI supports inquiry, not resolution.

- Intelligence is embedded in how the system is built, not in how it behaves.

- Complexity is absorbed by the infrastructure, not delegated to automation.

Technology, in this framing, operates as scaffolding for thought and making. It allows a non-engineer to construct a stable, human-scaled system without inserting a layer of algorithmic authority between the user and their own financial reality.

Translating the Stance into Experience

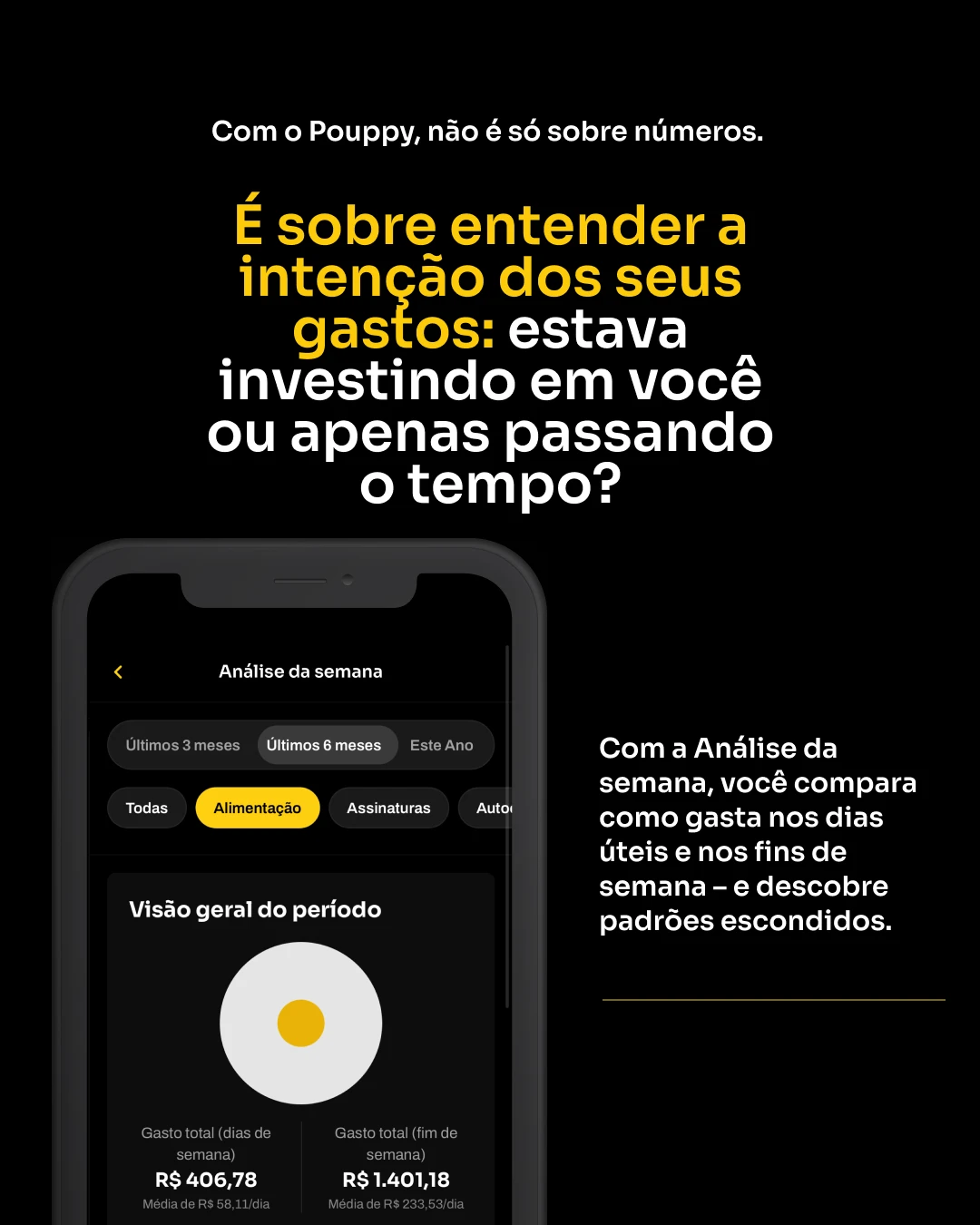

The product experience is structured as a ritual of presence rather than a control interface.

- Feedback prioritizes tone and continuity over alerts.

- Gaps in data carry no symbolic penalty.

- Returning after absence is treated as a continuation, not a reset or failure.

Visual systems such as proportional matrices and sentiment timelines translate abstract quantities into perceptible signals, allowing users to sense scarcity, rhythm, and accumulation without confronting raw numerical pressure.

Language throughout the interface avoids technical jargon, reinforcing the idea that the system is a companion, not an examiner.

Strategic Omissions

Product maturity in Pouppy is expressed through what is intentionally not built.

Key omissions include:

- Bank synchronization, which would sever the conscious gesture of registration.

- Dopaminergic gamification, which would replace permanence with short-term reward loops.

- Punitive budget enforcement, which would reintroduce judgment and avoidance.

These omissions are not constraints. They are safeguards for the central stance.

Who This Is For

Pouppy is designed for people who value coherence over optimization.

It resonates with those who:

- Are tired of oscillating between control and avoidance.

- Have tried multiple financial systems and abandoned them due to emotional overload.

- Prefer sustained clarity over aggressive performance metrics.

It is not intended for users seeking full automation, maximal efficiency, or the elimination of financial attention altogether.

Open Questions & Evaluation Principles

Optimization vs. Permanence

A central tension in Pouppy remains intentionally unresolved: the role of optimization.

Most financial products frame success as optimization — spending less, saving more, reaching predefined targets faster. This logic treats money as an isolated variable to be maximized and time as a neutral resource to be compressed.

Pouppy deliberately rejects this framing. Optimizing money inevitably means optimizing the user’s time, attention, and behavior according to external criteria. In practice, this often erases lived experience, personal desire, and situational nuance.

Designing for permanence requires a different question: not how to optimize outcomes, but how to sustain awareness without distortion. Money here is not an objective to be maximized, but a proxy through which people negotiate trade-offs, priorities, and limits.

The product does not aim to tell users what to cut or what to keep. It aims to help them see clearly enough to decide what feels coherent to maintain and what feels reasonable to let go.

Evaluation Principle

A feature in Pouppy is considered successful if it increases the likelihood that the user will continue looking at their finances over time.

If it accelerates decisions at the cost of awareness, compresses time at the cost of experience, or pushes users toward predefined notions of efficiency, it is considered a failure — even if it produces mathematically "better" results.

Permanence, not optimization, remains the core metric.